unlevered free cash flow enterprise value

Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business. The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at WACC less the value of non-common share claims such as debt.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

UFCF is a measure of a firms cash flow deprived from the firms core-business operation.

. The unlevered free cash flows used to value any company represent the companys enterprise value and those cash flows are available to all shareholders including equity and debt holders. When using unlevered free cash flow to determine the Enterprise Value EV Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest of the business a few simple steps can be taken to arrive at the equity value of the firm. A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy back stock service equity holders.

The DA and change in NWC adjustments to net income could be thought of as being analogous to calculating the cash flow from operations CFO section of the cash flow statement. Unlevered free cash flow is usually only visible to financial managers and investors rather than to the average consumer. Unlevered Free Cash Flow aka Free Cash Flow to the Firm UFCF and FCFC for short refers to a Free Cash Flow available to all investors of a firm including Equity and Debt holders.

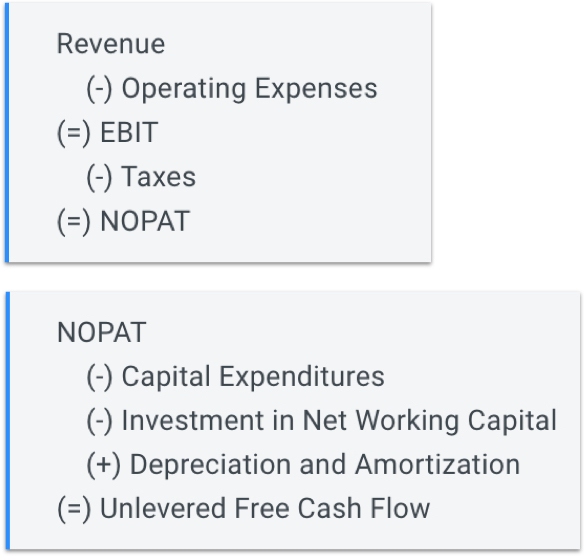

That is the reason you discount them back wacc because wacc reflects the riskiness of both cash flows to debt and equity holders. UFCF Free Cash Flow To The Firm is the cash flow available to all investors both debt and equity. The discounted cash flow DCF analysis represents the net present value NPV of projected cash flows available to all providers of capital net of the cash needed to be invested for generating the projected growth.

In financial modeling the free cash flow is used to determine the enterprise value of a firm. Unlevered free cash flow can be reported in a companys. The average consumer may not ever see or need to know this amount.

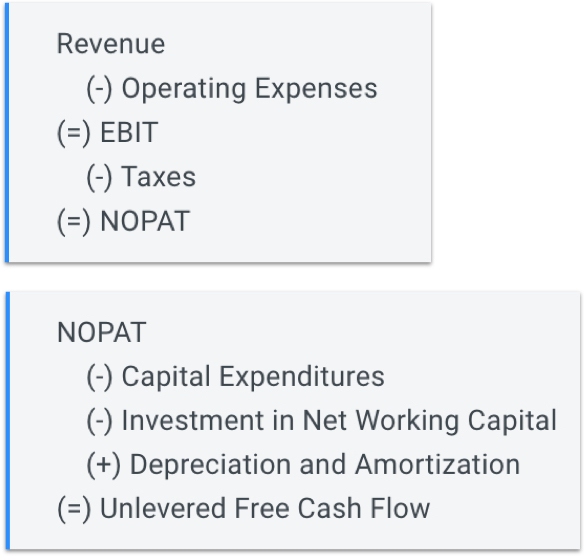

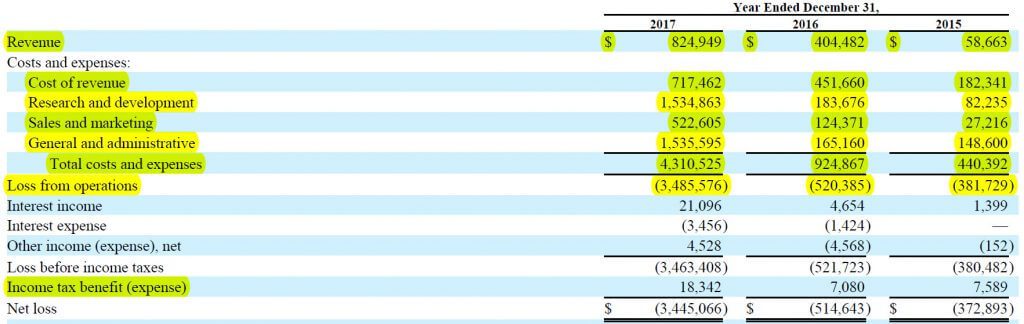

Levered Free Cash Flow Free Cash Flow To Equity looks for the cash flow that is available to just. Unlevered Free Cash Flow Operating Income 1 Tax Rate Depreciation Amortization - Deferred Income Taxes - Change in Working Capital Capital Expenditures Why do we ignore the Net Interest Expense Other Income Expense Preferred Dividends most non-cash adjustments on the Cash Flow Statement most of Cash Flow from Investing and all of Cash. Unlevered Free Cash Flow Formulas.

Unlevered Free Cash Flow - UFCF. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Forecast your future cash position and regain your control on your business finances.

Unlevered Free Cash Flow UFCF is the cash flow a business generates that can be given to both debt and equity investors. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. This metric is most useful when used as part of the discounted cash flow DCF valuation method where its benefits shine the most.

Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise. Unlevered free cash flow is a term used in corporate finance and investment analysis to discern a companys value.

When performing it with a discounted cash flow you will calculate the enterprise value. Offer a comparison of enterprise value to other businesses. UFCF increases Enterprise Value.

Another reason for its prominence is that most multiple-based valuation techniques like comparable analysis use enterprise value EV. The formulas for Unlevered Free Cash Flow or Free Cash Flow to the Firm are. Therefore the UFCF removes debt from the analysis.

It is the amount of cash a company generates after deducting interest payments income taxes and other expenses. Companies will pay the financial obligations from levered free cash flow. They are similar to the levered cash flows or free cash flow to equity except they value its operations.

FCFF Net Income DA Interest Expense 1 Tax Rate Change in NWC CapEx. The present value or leveraged free cash flow LFCF or equity cash flows discounted at the cost of. From the name itself unlevered means free from any form of leverage or debts.

EBIT1-tax rate DA NWC CAPEX best and most common Cash Flow from Operations Interest Interesttax rate CAPEX uncommon and used mainly in cases where there is a lack of PL information. It showcases enterprise value to debtholders with a stake in the companys financial wellbeing. This metric is important for business owners and investors alike as it can be used to make informed.

Unlevered cash flows are cash flows to both debt and equity holders. Now when you discount unlevered cash flows you will get your EV which is the total value of the firms debt and equity more precisely Equity Net debtprefered. The concept of DCF valuation is based on the principle that the value of a business or asset is inherently based on its ability.

Next we add back the relevant non-cash expenses like DA. Both approaches can be used to produce a valid DCF valuation. 21 Definition of Unlevered Free Cash Flow.

FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes.

Showcase enterprise value to investors. UFCF is helpful when a corporation wants to. Unlevered Free Cash Flow refers to any companys cash flow before any interest payments on debts are deducted.

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

Solved Calculate Terminal Value Calculate The Pv Of The Chegg Com

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Morrer Amigaveis Angulo How To Compute Fcf Autonomo Scully Bens Diversos

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

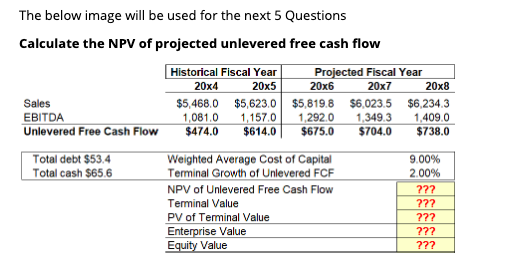

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial